8 Strategies To Capitalize On Untapped Global Markets

Startup Professionals Musings

JANUARY 22, 2023

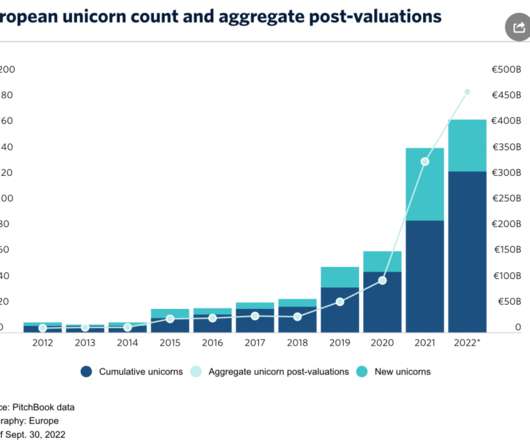

From my consulting with entrepreneurs in Europe and other countries, I’m convinced that we all could benefit from adapting to meet their environments. He comes from a background in venture capital from inside and outside the Valley, as well as entrepreneurship work with startup efforts around the world.

Let's personalize your content