What Does the Post Crash VC Market Look Like?

Both Sides of the Table

SEPTEMBER 15, 2022

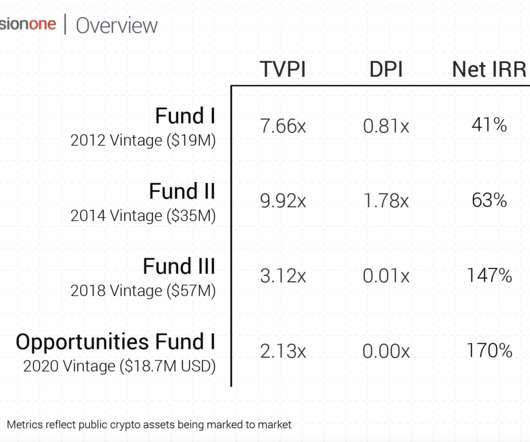

IRRs work really well in a 12-year bull market but VCs have to make money in good markets and bad. But it will be patiently deployed, waiting for a cohort of founders who aren’t artificially clinging to 2021 valuation metrics. It’s just math. What is a VC To Do? I can’t speak for every VC, obviously. super size or super focus.

Let's personalize your content