Since returning from MIT back in June I’ve been focusing on the growth of the company. It has been pretty much on mind non-stop for months now. The part that I’d like to zero in on is when you’ve got a high growth company what are some of the best practices out there to distribute equity to the founders, advisors, and employees?

Equity for Founders

The Founders’ Pie Calculator by Frank Demmler, an Associate Teaching Professor of Entrepreneurship at the Donald H. Jones Center for Entrepreneurship at the Tepper School of Business at Carnegie Mellon University invented an interesting way to divide equity between founders in a way that is both logical and fair. Sometimes when people start up a company they make decision to divide up the equity evenly because it’s “fair”. Demmler’s approach is a bit different in that the calculator provides a way to quantify the elements of the decision making process, and that it appears to be logical and fair. The elements of the decision making process are 1) Idea; 2) Business Plan Preparation; 3) Domain Expertise; 4) Commitment and Risk; 5) Responsibilities.

The idea behind the calculator is to come up with a weight for each of these five elements and then assign a value to each founder on a scale of 0-to-10. Then you take the weight and multiple it by the founders score to come up with the weighted score. From there you can get the percentage of equity. I like this a lot better than splitting things equally because it allows you to quantify what is important. See table below for example of how this works.

[table id=11 /]

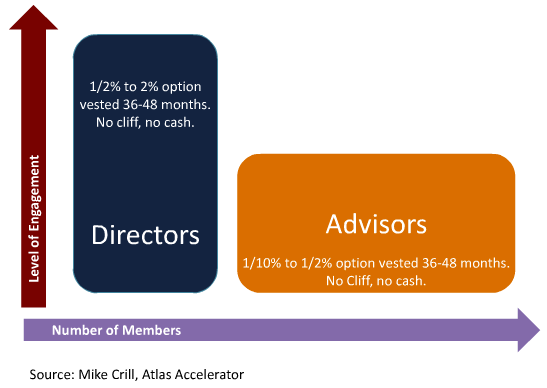

Equity for Board of Directors and Advisory Board

When figuring out how to provide equity to advisors, you can use this chart as a guideline. Typically for an Advisory Board it ranges from 1/10th of percent to 1/2% and for Board of Directors from 1/2% to 2%.

Equity for Employees

It’s important to figure out how much equity you give to your employees. David Crow writes in his article “Founders versus Early Employees“, “Remember the goal is to incent early employees to have an emotional ownership of the product and company they are building. Equally said, potential employees need to understand what they are getting into”. The one thing that I think is missing is distributing equity to every single employee in the company regardless of title. Quite honestly, it takes an entire team to build a company and giving each employee a piece is important so that employees are rewarded in the upside of the company as they have made a decision to work for you instead of some other opportunity. Giving equity to employees also helps foster the “act like an owner” kind of mentality. Below is an example of how some companies may approach distributing equity to employees.

[table id=12 /]

Number of shares = Meaningless. Just the % Matters

Chris Dixon wrote a blog post about “The one number you should know about your equity grant“. The one number you should know about your equity grant is the percent of the company you are being granted (in options, shares, whatever – it doesn’t matter – just the % matters).

- Number of shares: meaningless.

- Price of shares: meaningless.

- Percent of the outstanding option pool: meaningless.

- Your equity in relation to other employees: meaningless.

- Strike price of options: meaningless.

All this information that I’ve gathered up here seems rather logical. Are there other tools that you’ve used that you think would be helpful to share with other entrepreneurs and founders? Are there principles that you live by that you’ve implemented in your startup that have worked really well? How long should people vest – four years? Five years? No cliff? Should founders have anti-dilution rights? I would really like to hear your thoughts on this.