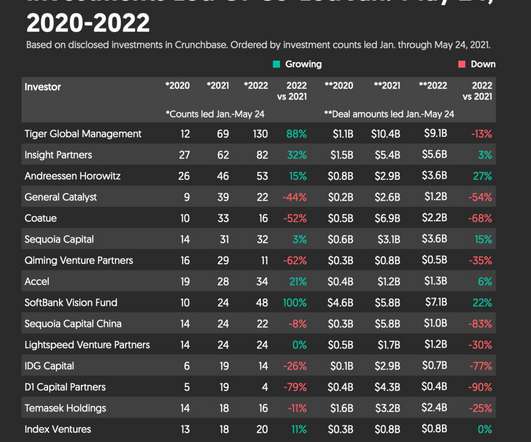

How’s Venture Capital Changing in 2023

VC Cafe

FEBRUARY 27, 2023

Taking stock of the venture capital market in 2023, it’s clear to see that we’re in a transition point. And young investors who left careers in banking or consulting to enter venture feel disillusioned – they didn’t think it would be this hard. billion in new funds in the fourth quarter.

Let's personalize your content