Melody Koh

Five to ten years ago, it was thought that digitally-native brands and e-commerce retailers had a distinct cost advantage because they didn’t have to pay for legacy physical infrastructure (e.g. storefronts with long-term lease commitments), which represents high fixed costs and reduced margin.

Now in 2018, I believe that digitally-native brands should actually develop a holistic picture across offline/physical retail, brand marketing, and performance marketing earlier in their lifecycle.

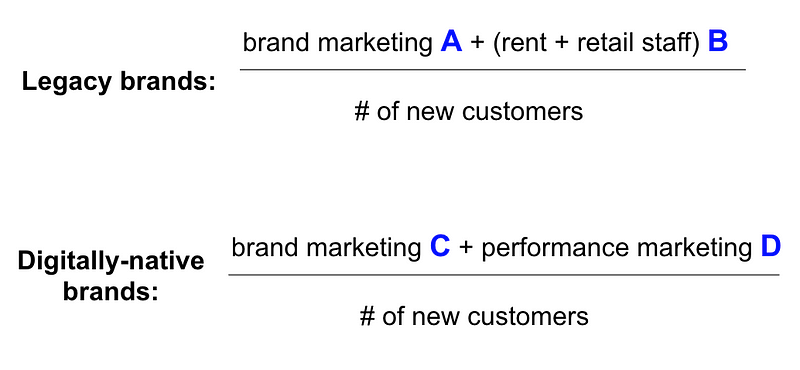

To understand the historical argument around the digital-only cost advantage, put rent (and cost of staff) alongside traditionally defined marketing cost when considering the true cost of “acquiring a new customer¹”:

Digitally-native brands should start with a very small D that can be scaled nimbly (and only pile on C when the company reaches certain size/scale), compared to starting with B, which is hard to flex incrementally. D also has distinct advantages around attribution and targeting capabilities. As a result, it has historically been the case that D is just a better bargain vs. B. If you can just pay CAC, why commit yourself to rent?

However, with more and more emerging brands and startups chasing after the same inventory in D, basic supply and demand (and users’ limited attention span) are driving up everyone’s unit cost.

This is resulting in the recent sentiment that “CAC is the new rent” — what used to feel like efficient performance marketing dollars increasingly feels like blocks of cash you just throw at various channels and hope for the best. D occasionally gets a break when a new channel emerges (and there exists a temporary arbitrage opportunity until all other marketers figure it out).

Before the next Facebook or podcast emerges, what’s the path forward?

A new approach to consider: consider rent as another channel input into your blended CAC

Even when you’re still a relatively young brand, I’d encourage you to think about your marketing channel mix inclusive of offline/brand marketing type channels as well as physical retail.

This is easier said than done.

The beauty of D (and to a lesser degree C) is that you need to commit very little. Low on cash? Just turn off some Instagram ads tomorrow. Flexibility and optionality are valuable, especially when you’re a young company with uncertain future and constantly changing competitive landscape.

Below are a few considerations on how to put this to practice:

1. Be deliberate about the right “channel/creative mix”

Each channel has its unique strength around communicating the brand / product value proposition — to create maximum efficiency, you want to be purposeful around what you’d like to get across where, and how.

For example, physical retail has a unique advantage in creating a brand experience and showcase experiential/emotional (i.e. non-utilitarian) attributes of a product that are otherwise hard to convey digitally — but this only matters if you’re selling products with such value proposition.

2. Go where your customers are

Segment your addressable market and try to get a good understanding of what channel(s) are most efficient in reaching a given sub-segment / demographic.

Despite our eyes being increasingly glued to the screen, we still live a physical life and people still go places. For example, it might be most efficient to reach 25-year-olds living in NYC on Instagram these days; to reach 40-year-old moms with two kids living in Minneapolis, you might want to be seen next to their go-to grocery stores (which they frequent 3x/week).

3. Consider it a “point solution” and go as asset/inventory-light as possible

Unlike performance marketing, physical retail is not nearly as scalable and requires real commitment, so you want to smartly deploy such resources only in places you need it most, with an eye towards reinforcing key regions / demographics.

Given the maturity in e-commerce transaction and fulfillment stacks, your physical footprint should really focus on helping customers “evaluate” a purchase decision (vs. fulfilling it) — e.g. inventory-less showroom style stores, a space that focuses on brand experiences and certain product attributes that are hard to convey digitally. This approach allows you to establish a physical presence in a more capital efficient way and avoids the legacy infrastructure commitment.

4. Stage it, but consider the holistic picture early

Performance marketing is the easiest to start even if you have very little capital (and attribution is the easiest), so every startup tends to start there. It’s like a drug that you can’t quit, which is why most companies spend a long time focusing on these channels until they run out of efficiency.

To the extent you can, start experimenting with offline/brand marketing channels and physical retail (if what you’re selling can take advantage of such channels’ strength). Every company is different, so it’s critical to understand how these different channels can work together for you: whether they should be leveraged synergistically or as channels for distinct sub-segments of your target audience.

This is not a post that advocates for physical retail for every consumer brand/company out there, but one that encourages a holistic consideration of marketing channels inclusive of physical footprints. You might find that a storefront in Dallas is more cost effective than your storefront on Instagram.

[1] For simplicity, we’re just going to focus on new customer acquisition (vs. also considering building up lifetime value/LTV through repeat purchases)