5 Steps To Finding The Best Investor For Your Startup

Startup Professionals Musings

FEBRUARY 10, 2023

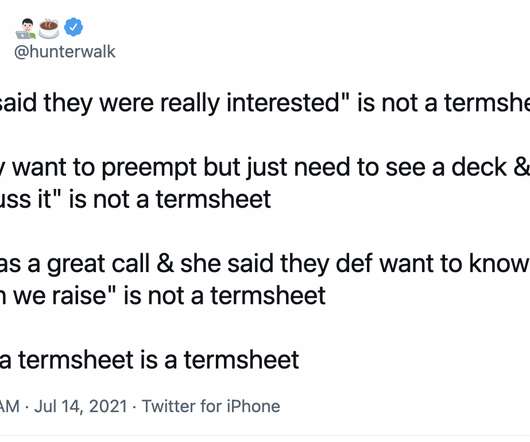

Reverse due diligence on the investor is a comparable process whereby the entrepreneur seeks to validate the track record, operating style, and motivation of every potential partner. To get the terms you want, it’s better to start with your own term sheet. Know your partner well before you get married.

Let's personalize your content