10 Keys To Surviving Startup Cash Flow Requirements

Startup Professionals Musings

SEPTEMBER 13, 2022

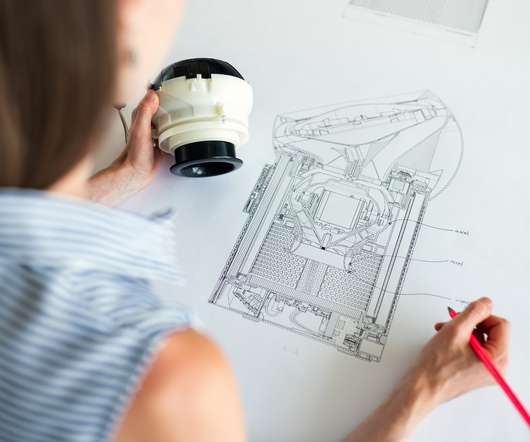

The “valley of death” is a common term in the startup world, referring to the difficulty of covering the negative cash flow in the early stages of a startup, before their new product or service is bringing in revenue from real customers. Join a startup incubator. Use crowd funding to build reserves.

Let's personalize your content