There’s no doubt that AngelList has evolved into an incredibly powerful (and disruptive) platform in the investing world. The hybrid social network, communication and crowdsourcing platform allows startups to access investors, and has also become a resource for investors looking to boost dealflow and connect with other investors. But while the network has been able to connect investors with startups, there hasn’t been a way to facilitate the actual transaction online. Today, AngelList is debuting Docs, which lets seed-stage startups close their round online. It consists of a standard term sheet, automatically generated closing documents, and tools to manage the process including electronic signatures, managing wire information, generating PDFs, and more.

As CEO and co-founder Naval Ravikant tells me, when he and co-founder Babak Nivi started VentureHacks a few years ago, their goal was to educate companies on how to negotiate venture term sheets. AngelList eventually resulted from this, and actually helped startups make connections to investors. The next step is actually facilitating these deals. One challenge for startups, says Ravikant, is dealing with large legal fees.

For a seed stage round, legal fees can be upwards of tens of thousands of dollars, which is costly for a bootstrapped startups. Docs aims to eliminate some of the complexity of the actual raise by allowing users to enter information in fields, and produce a term sheet.

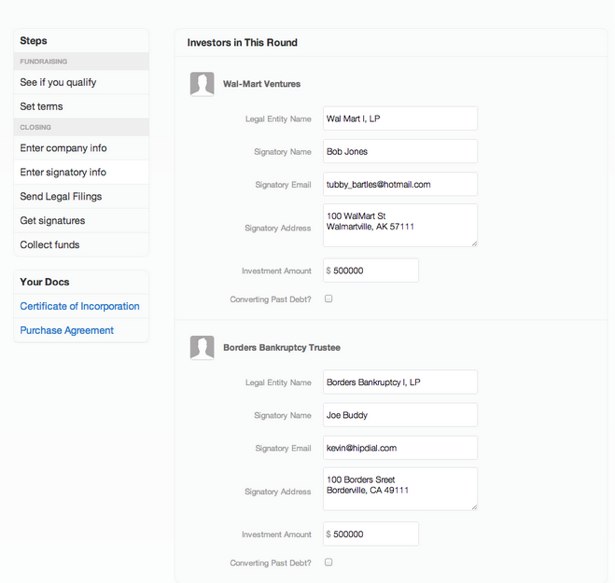

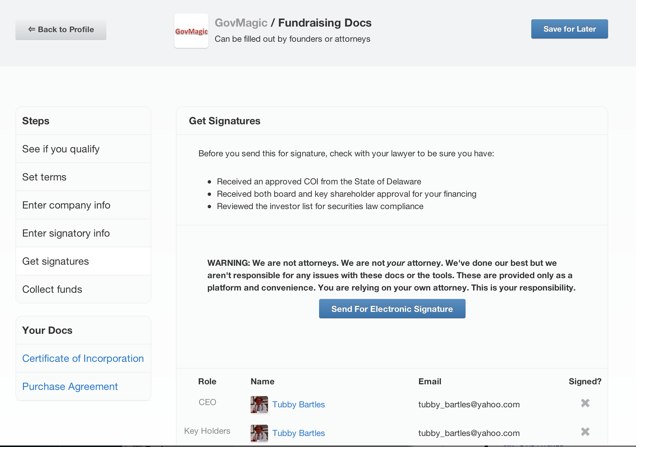

Startups are guided through the closing by inputting information such as investors, the amount invested, how much is being raised in total, vesting schedules and more. AngelList will then automatically generate a term sheet and closing documents. Currently, Docs supports equity (via Ted Wang from firm Fenwick and West) and convertible debt (with the help of law firm Perkins Coie) with minor modifications through side letters. Ravikant says the term sheet and closing documents are based on industry-standard Series Seed documents, so there is little to no negotiation involved. In fact, AngelList worked with law firm Wilson Sonsini to create the documents.

While startups may still want to have a lawyer look at the documents for review, the costs will be minimal (a few thousand dollars vs. the amount mentioned above). In fact, Wilson Sonsini will close financings for startups using Docs for their seed rounds but you must become a client of the firms. And AngelList Docs can be used by any lawyer with their own clients.

Startups Lookmark and Cucumbertown have already used Docs to close their seed rounds while it was in early testing. There are also several companies using Docs to close their round right now. AngelList says hundreds of companies have also used the underlying Series Seed documents in Docs to close their rounds.

Dave Zohrob, CEO of Lookmark, told us that the Docs feature made fundraising very straightforward and simple. The startup, which raised under seven figures, saw legal fees decrease by tens of thousands from a previous seed round, which was coordinated by a law firm and cost $20,000

Currently, Docs is in limited release and startups must apply to use the application. Eventually Docs, which is free to use, will be released to the general public.

Ravikant says that startups were asking AngelList for standard closing docs routinely, so the addition made sense. And while the startup could have just added standard PDF documents, AngelList wanted to create an interactive way for companies to navigate the closing process where they could enter variable terms into a form to receive more personalized documents (thus, decreasing legal fees).

For AngelList, Docs represent the next generation of the network’s product. AngelList has been able to help over 1,500 companies meet investors that financed them and companies that raised on AngelList have gone on to raise over $1 billion in funding. But now, the network can actually be a part of the actual transaction, which can provide massive amounts of data.

“Now we get to see actual transactions happening. Before we had to guess how many connections were actually financed,” explains Ravikant.

This isn’t the first feature that AngelList has launched to help startups and companies in fundraising efforts. Earlier this year, AngelList debuted a more interactive pitch deck.

The fact is that there are more resources in fundraising now for startups than there ever has been. Between VC transparency, TheFunded’s VC reviews and recently launched equity notes, and AngelList’s network and features; startups have more information and access to make the investment process more seamless and successful.