How long does it take from first meeting a VC to getting cash in the bank?

That's an interesting question. Theoretically, someone could meet you, sign your document, and write you a check for deposit that day, but that's not how it usually works.

It's also not the best way to create a helpful syndicate of investors that share the founder's vision for the company.

Examining the actual data not only gives me some insight into my close process, but it helps me calibrate around relationship building. If all my deals came as intros from trusted connections that I know for years versus at founder pitch events that's interesting data. I might decide that I'm not mining one side or the other, or I need to redouble my efforts to build relationships with the people I know longest.

It also helps me figure out who I should be spending my time with. If it turned out that the best experiences I've had as an investor come from knowing someone a long time, I might go to events that are more around a specialty, like software development or design. In this case, I'd have the benefit of knowing someone long before they created a company. If you meet someone at a pitch event, they've already got a company and they're looking to close as quickly as possible.

In fact, that's what I tend to do--at least, what I say that I do. The way I choose conferences and events, and my strategy once I'm there, is based more around who I'm going to back two years from now than it is who is raising now.

But does the data play that out? How long in advance did I know someone, or know about a deal before I wired money? What led me to knowing about that deal in the first place and when did that event happen?

I went back across the 21 investments I've made both at First Round and at Brooklyn Bridge Ventures--a period that dates back to January 28, 2010, when I closed on Backupify. I looked at how I got the deal, when I first met the company, when it closed, and then what connection I made to be in a position to get the deal in the first place. For example, while I closed on the seed investment in Tinybop on November 19, 2012, I met Raul two years earlier at the first Brooklyn Beta in 2010, even before he was working on the company. Similarly, I got introduced to Chantel Waterbury from chloe + isabel by Bo Yaghmie from Cooley, who was my lawyer when I had a startup--so I had to trace back when I first got introduced to Bo by Fred Wilson. That was three years earlier.

Of course, if I really wanted to go nuts, I could say that I had to be born, my parents had to meet, and the universe had to begin for any of these deals to happen. That would get silly after a while, so I just kept it to the immediately prior traceable event. If someone introduced me to a deal, I went back to when I met that first person. If I already knew the founder, I went back to when I first met them, and then marked the day they started their company as the first pitch day.

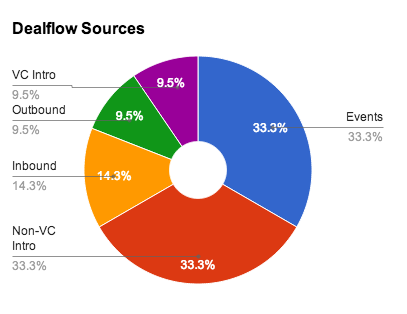

The first thing I did was trace my sources. Here were the results:

I would guess that getting a third of my deals from events is probably disproportionately high compared to other seed investors on the east coast--and that my VC intro percentage is probably somewhat low. The latter is someone I've been more conscious of lately and I've been working to share more of what I'm looking at with other investors, in order that they share more in return. That seems to be paying off as I'll likely close on a deal this week that came from talking about dealflow with another investor.

You might be surprised that I don't get more inbound deals given all the work that I put into my blog, Twitter, and newsletter. Actually, these things play an important role, but not in the way that you might think.

My social media streams actually do more to keep existing connections warm than they do to create new ones. It's a way for people to follow along on what I'm up to and to keep me top of mind when they do encounter a company. I would say most of the times that I've gotten an introduction to someone, it came right after the person making the intro read something that I put out there.

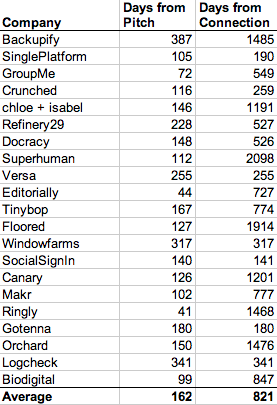

So how long does this all take? I did a lot of inbox mining and came up with the following:

So, on average, something I did almost two and a half years in advance let me to getting these deals, and from the first time I encounted them, it took about five months for these deals to close.

Five months?

Two and a half years??

Who has that kind of time???

Fear not, founders. I could turn around a deal and close in the same week--heck, even in the same day if I needed to. It just doesn't seem to happen that way. I'd say my average turn around time these days on saying yes is probably within a week. So what's taking so long? A lot of times, it's a process of gathering other investors for a round. It's also a function of meeting the entrepreneur before they've really decided what they want to raise, or before they have a deck. I'd say that five months is the amount of time I'd pencil in from the day you're ready to tell other people about what you're up to, rather than how long it takes to close a round. The tricky question is whether these early conversations should count as fundraising. When you approach someone to catch up and tell them what you're up to, are you pitching? Most founders would probably say no and most VCs would probably say yes.

To me, these early conversations were extremely critical to helping me get to know a founder, to sharpening the plan, and to build relationships for later rounds. To go back to the Tinybop example, Raul wound up pitching Steve Schlafman while he was at Lerer Ventures very early on, and Steve came back to lead the Series A in the company more than a year later.

As for the two and a half year mark, it should say a lot to anyone looking to get into venture. One of the most important assets you have is your network--but it's not your network of founders. It's the network of people who respect what you can do for a founder enough to make an intro. That's what this multi-year relationship is all about. It's interesting to note that a lot of these people were founders themselves that I didn't back, but I stayed in touch with. They went on to do other things besides their startup and connecting with them turned out to be really important.

It also seems to reinforce a lot of the activities in the community that connect me to interesting non-founders. These are the people that, a few years down the line, are going to run in the circles later that I would like to be connected to.

So if you don't see me at a pitch event or a demo day, it's probably because I'm meeting up with someone from the future.