02 3 / 2018

Surprising findings from our 2017 investments

I took a look at what we invested in in 2017 and thought I’d share some surprising / not surprising findings. I realize that investors are often a black box, where it’s hard to understand what they prefer and what their biases are. Hopefully by sharing some of these stats it will help illuminate what we care about.

Note: these stats are based off first checks we did in 2017 under Hustle Fund – I did not include follow-on checks.

1) We invested in many places but not in enough places.

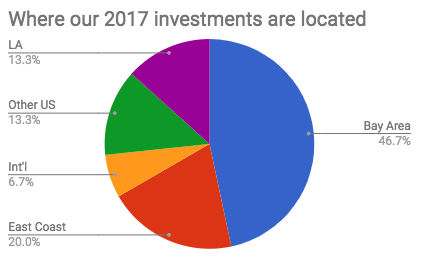

Our mandate is to invest in US / CAN entities, so almost all of our investments are concentrated in the US and CAN from a geographical perspective (except for 1 company). All are legally incorporated in the US and CAN. Here’s the breakdown from last year:

Some quick thoughts:

A) We invested in way more Bay Area companies than we had anticipated.

B) We made no CAN investments! :(

C) Though we did no investments in TO/Waterloo, Atlanta, Boston, and really anywhere in the midwest in 2017, we have done a TON of investments in these locations in the past and will likely look heavily there in 2018. A big reason for this skew is that we’d known a few companies – either colleagues / friends / or founders we’v worked with before, whom we wanted to back right out of the gates. In the long run, however, on this fund, I expect the Bay Area to consist of around 35-40% of our investments.

2) Almost half of our companies have at least one female founder.

47% of our portfolio companies have at least one female founder. In most cases, she is the CEO. Although this is probably better than most VC portfolios, in the long run, I think we can still do better.

Note: for this stat (as well as the next one on race), we asked our founders to self-identify. What I would love to understand, though I think it’s impossible, is what the overall funnel looks like. I can’t tell you if 47% is actually a good number or not, because I don’t know what percentage of the companies who are pitching us have at least one female founder. (We do not ask about gender or race of our applicants).

That being said, my intuition is that the vast majority of pitches that I get have at least one female founder. I don’t know if that is because my networks are different from Eric’s. Or if women prefer to pitch to female investors. Or if it’s purely coincidence. But, I suspect there is something interesting here, where you can make a strong case for having funds run by GPs of different backgrounds and networks.

Lastly, pitches that start out as “I am a female founder” actually make me think that a founder doesn’t know how to run a business. Investors are in the business to make money; I really don’t care about what you identify as - as insensitive as that sounds. I’m doing this to make my investors money (and hopefully some for me too :) ). Here in the US, green is always green.

3) The racial diversity in our portfolio is ok but could be a lot lot better.

Again, these stats are based off of self-identification. One thing I noticed is that our mixed-founders identify as “other”, so if someone is say half Black and half Asian and identifies as “other”, he/she does not get included in any of the below stats.

- 20% of our companies have at least one Black founder.

- 7% of our companies have at least one LatinX founder.

- 53% of our companies have at least one Asian founder.

- 53% of our companies have at least one White founder.

- None of our founders identify as Native American.

I am happy with this start, and our portfolio is probably better than most VC portfolios, but I’m sure we could do a lot lot better and have a number of efforts for later this year.

Again, I would’ve loved to have examined the pipeline of companies we looked at but did not invest in, but this is just not possible logistically.

4) We do not always meet our founders in person.

In 27% of our investments, we still have not met the founding team in person.

I think this is pretty unusual for most VCs. There are a few premises of why this is possible:

- I’ve hired a lot of remote folks before for my startup, so remote-coaching, which is a lot less hands-on certainly works

- This allows us to invest in geographies where we are not physically located

- You don’t actually really know-know people based on location; it’s based on time and interactions

- Business success is based on results, and I can see that in other ways

In addition, I usually try to have most of my initial conversations with people over email before we hop on a call. This is a tip I learned from my mentor David Hauser (founder of Grasshopper - acq by Citrix) who actually invested in my company LaunchBit over email! It’s a lot more efficient to cut to the chase and not waste anyone’s time in an email, and I can send a quick email with a couple of questions at midnight.

I suspect, but have no data, that this process of first talking concretely about a business over email and then moving people to a phone call actually removes a lot of unconscious biases. I have no idea what people look like or how they dress or if they’re pregnant or whatnot. Again no proof though.

What I ultimately care about is speed of results.

5) We skewed towards B2B companies.

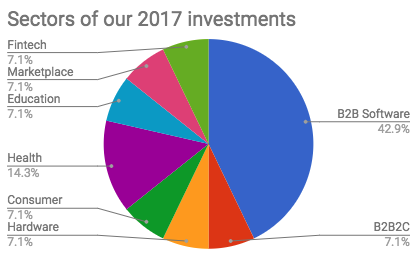

As I’ve mentioned in a prior post, we are certainly biased towards B2B companies!

43% of our companies are B2B companies. But even the companies I’ve put into other categories are also either B2B SaaS companies OR have a B2B partnership model to get consumers.

I’m not sure whether stating this will either attract more B2B companies or deter consumer companies, but regardless, I thought that I would mention this stat. We do try to keep an open mind going into all deals, but clearly we have our biases as you can see here.

In 2018, though, I can tell you right out of the gates that we’ve been doing so much more in blockchain. So, we’ll see a bit of a sector skew.

6) We invested very early in 2017. And love Lean Startup 101.

60% of our companies were extremely early. I.e. product was rudimentary / concierge-based MVP / etc. But a common characteristic of most of these companies was despite essentially having no product, almost all the companies we backed had some sales. Many of these founders hustled sales before having a strong or fully-fleshed out product. You might assume that the typical Hustle Fund founder profile is sales or marketing oriented, but this isn’t necessarily so. Some of these teams only have product / engineering founders, but the impetus behind having a limited product is to make sure that you’re constantly learning from customers / users and that you’re only building out what users/customers want - resulting in faster iterations.

Essentially we really like founders who are very good AND FAST at the Lean Startup Methodology. This is something we are quite biased towards – getting results even before having a full-fledged product to inform product decisions.

BUT, as I’ve written about before, 2018 is a different fundraising landscape (and still changing!). And, so we are looking for more traction in our 2018 investments in most categories than in 2017. Part of this is that our founders will need to achieve more in order to get to their next round. And, by investing too early with such a small check, there’s a long time span between our check and the next round. And as a small investor, we need our companies to get to the next round with very little capital.

Hopefully these stats are illuminating. In 2018, I think we will see a lot of changes along geography and race as we ramp up our own activities. We will likely see little to no changes along gender lines. And I suspect we will see some changes in sector (more blockchain & health) but still tons of B2B in some way or another. And probably lots of changes in traction levels as well. Just my prediction right now, but we’ll see at the end of this year.

Fundraising is a nebulous process that I aim to make more transparent. To learn more secrets and tips, subscribe to my newsletter.

Permalink 2 notes