Last week, on Martin Luther King Day, I decided that instead of saying something in my weekly newsletter, I would do the opposite--I would listen.

I asked, "What is your experience of being be black in tech today and what can allies do to improve it?"

The responses I got came at a time when I've been having a lot of conversations with female founders as well about their fundraising experiences. At this moment, I'm in the process of backing three companies that have at least one female founder and I just finished a round for a black female founder in December.

While being female and being black are clearly not the same thing, they do fall into the category of "not white men", which the fundraising environment favors--but perhaps not in the way people assume.

This will be the post where I dangerously attempt to walk the minefield of a white male VC opining on the topic.

After backing a higher percentage (around 50%) of founders that would fall into various diversity categories and listening to a lot of people's perspectives, here's what I've come to believe about diversity and the fundraising environment--and I'm open to new perspectives on it.

But first, a disclaimer:

I'm a straight white guy and come with all of the requisite biases and privilege--and so while I cannot speak for anyone outside of this category, I'm attempting to provide a helpful perspective from the funding side of someone who is listening and actively backing diverse founders.

I've opened the comments on this one--because while I normally think comments are kind of a pain in the butt to manage and I'd much rather someone e-mail me if they really cared to have a conversation, I think it's important enough for this post to get into as much dialogue a possible. I will not, however, tolerate hate in anyone's direction.

Ok, now that those two things have been addressed, here's what I believe is true--and, more importantly, simultaneously true:

1) Diverse founders face conscious and unconscious discrimination.

2) Yet, the vast majority of investors would back anyone they thought could make them and their investors money. Why they haven't is not an uncomplicated issue and does not have easy answers.

3) The fundraising process favors white men.

4) The diverse background of the founder is not the main reason why most diverse founders get turned down for investment.

5) Both diverse founders and investors need to change their behavior if the funding statistics are going to change.

[Ducks head.]

Ok, let's dive in...

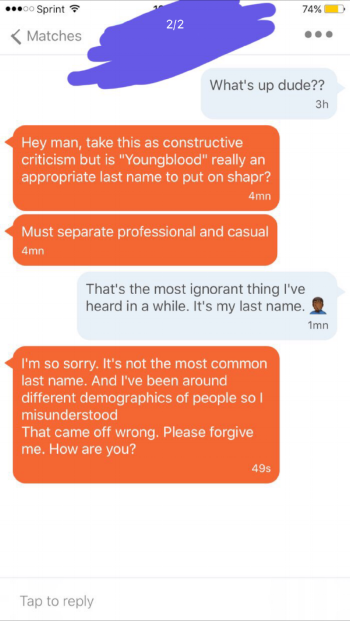

There is discrimination in the world. This should surprise no one. This was what one of the founders who wrote back to me last week sent.

On an app advertised to "meet inspiring people" for meaningful networking, someone tells this black founder, whose last name is "Youngblood" that is name is inappropriate.

Clearly he assumed that he was using some kind of username, and that it was a gang reference of some sort--like, "Young Blood" as in the bloods and the crips or something to that affect.

The person goes on to blame the uncommonness of the name. Do you think he would have had the same reaction to former Major League Baseball utilityman Joel Youngblood?

I highly doubt it.

Diverse founders here that kind of idiocy all the time, and undoubtedly it's incredibly discouraging. Investors need to give some serious thought to what comes out of their mouth before speaking if they're going to make any improvements. They need to do more to be conscious of their unconscious biases and that doesn't come without real work.

They also need to be not only receptive to feedback, but they need to create a space where they appear like it is welcome.

That being said, that doesn't mean that just because you run into an investor who says something unintelligent or insensitive doesn't mean they aren't interested in funding you because of who you are.

This is where the power dynamics and frankly the social dynamics get tricky. An investor might say something they shouldn't and now, as a founder, you're put in an awkward position. You have to decide whether or not to say something, potentially risking your funding.

I'll say two things about that.

First, if any investor isn't open to getting feedback about their actions, especially related to diversity and especially in today's ecosystem, that's not the kind of investor you ever want to take money from. That relationship is just going to go from bad to worse and will be more trouble than it's worth.

Second, there does not exist a world where you have an idea that should get backed, but only one human being on the face of the earth will fund you--and that person is an asshole. Move on, keep looking and find people who are truly supportive, on your terms.

Ok, second--most VCs are just looking to make money for their investors. There a lot of systematic things going on in the ecosystem but investors specifically not backing women or people of color or any other specific groups just because of who they are is not a widespread phenomenon. I am not excusing why their pipelines are so skewed or how their filters for vetting potential success are biased--those are separate issues that need to be addressed. What I'm saying is that the vast majority of investors are open to backing lots of different kinds of people. That is what I believe, in spite of the industry's piss poor outcomes thus far.

Third, there are a lot of aspects of the fundraising process that favors straight white guys.

For example:

The need for a warm introduction is bullshit. I've written about this before. It's been proven that most people's networks look like them--and so if you're only interested in backing people who look like you, warm intros are the best tools for perpetuating the lack of diversity in your pipeline. If you don't want to respond to cold e-mails, you don't have to. No one is owed a response just because they reached out to you.

However, if you don't want to evaluate your inbound deal opportunities, that's the job, my friend. Your network never signed up to do your outsourced job for you. If you can't handle the cold inbound, hire some help. If you can't afford it, then your firm model is broken and you should get out of the business. Vetting deal flow is part of the job. Just put up some clear criteria, like "I only fund NYC companies" or "I only fund enterprise" if you want to improve the filters. If the founders ignore that and bust through anyway, that's their fault and they shouldn't expect you to respond.

Besides, how effective of a filter is it that someone can get coffee with a non-VC and convince them that you'd want to see the deal? If these people were any good at vetting deals, they'd be an investor, too.

I don't want to outsource my deal vetting to people who don't do what I do for a living.

Another thing that skews the process is the lack of accessibility of many partner-level VCs, especially to diverse communities. Look, I get it. You're a partner at a firm, you're married, have kids, etc., and you don't have as much after work time to go to every random meetup. At least go to *some* and start asking the people who run those events what they're doing to diversify the audience. Do they have a Code of Conduct? Have they marketed the event to any groups where diversity is a criteria or part of their mission?

If you're going to mix up your normal "in network" dealflow with an open event, perhaps you should think about ways to make that event look more like CUNY than Harvard--because the Harvard founders can undoubtedly get to you in other ways.

Another issue with the kinds of events people have to participate in for fundraising is the type of events and how they obviously appeal to certain demographics. Golf, according to Nielsen, has a demographic that is 87% white--so if you're looking to expand your pipeline, perhaps that's not the right sport. What about pitch competitions that sound like Ancient Roman death matches? How enthusiastic are women going to be to participate in shark cages and battlegrounds? They do, and I'll join these events, but when you name your pitch event after something violent, you shouldn't be surprised when you've gotten way more men to apply.

Funding isn't a zero sum game, so you shouldn't tell all the Christians that it's either them or the lion, best Powerpoint wins.

Yet, after all these hurdles, the fact of the matter is that most founders do not get funded.

It doesn't matter if you're white, black, gay, straight, male, female.

Most founders strike out.

Most straight white male founders strike out.

And, in fact, we don't actually have good statistics as to the percent of each that attempt to get funding--so we don't actually know whether any particular group does better. We know the outcomes--but we don't actually know the top of the funnel.

In other words, if 10 female founders pitch a fund, and one gets funding, that means 10% of the founders that pitch a fund get funded. If 100 male founders pitch that same fund, and only 9 of them get funded, then men are actually doing statistically worse than the women at getting funded by that firm.

Does that fund potentially have a pipeline problem? Yes.

Should more of those female founded companies have gotten funding, because they were better companies? Maybe, but there's very little objective way to fish that out. Just because you have revenues and someone else doesn't doesn't mean

We could have a whole conversation as to why certain groups are pitching or why they or not, and ways to increase the attempts to get funding--but I think what gets lost too often is the fact that getting funding is really difficult for everyone.

What I notice is that when straight white guys get turned down, they tend to blame the investor.

When everyone else gets turned down, they tend to blame themselves--they are more likely to assume it was something about themselves, maybe just that they're black or female, that led to the turndown.

It's difficult to assess whether the reason why a black female isn't getting funded is because of a problem with her business model or whether it's because she isn't getting taken seriously because of who she is.

What I do know is that both sides need to adjust their behavior in the face of this--to make sure that everyone is getting their fair shake.

Diverse founders need to get right to the heart of why the investor says no, and try hard to objectively take the critique. For example, if someone says "too early" ask them very specifically what is the measure of early, and what's the earliest along those lines they've made an investment, and what's the average. You might hear that the firm has never made an investment in someone with less than $25k worth of monthly revenue, which is a fine criteria to have, but at least it takes you to an objective place where you know why you're falling out of their process--and you have a goal if you ever want to pitch that fund again.

With consumer products, it's a little more difficult. I've given specific feedback to diverse founders as to my thoughts on why consumers wouldn't adopt a particular app. I could be wrong, but there's really no way to have an objective conversation about that unless you get traction. That doesn't mean that traction is a requirement for me--it just means I don't believe that particular app will get it. It's important to me to be open to being proven wrong, but it's also important for the founder to understand that most ideas are being rejected for funding--and not to assume it's always because of them.

On the investor side, I think investors need to be a little extra thoughtful and constructive when giving feedback to diverse founders. Let them know exactly why you're turning them down and what they can do to improve their pitch--lest they think you're simply not funding them for who they are, which can be super discouraging for them and create a bad reputation for you.

In my mind, one of the biggest changes that needs to happen in the ecosystem for diverse founders to get more funding is for them to ask for more.

Overly simplistic? Perhaps. Mathematically accurate? Incontrovertibly.

In my experience, the fast majority of $500k rounds or less that I've been pitched for come from either female founders or founders of color--something like 90%. A tiny round might be appropriate for some companies. Maybe you've got a small set of technical founders that aren't even sure if this product will function and they're just testing it out. Maybe there's a huge customer risk and that money could test whether or not *any* customers would use this product, and if they did, that would make it a lot easier for other investors to buy into the plan. Whatever the case, that's not most of what I'm seeing.

I see far too many diverse founders asking for such small amounts of money that they're signaling smaller ambitions. If you believe in your idea and have a model that backs up what you actually need to get to the next level of value creation, then pitch for what your company needs, not what you think will get funded. Yeah, I know all the stats about who gets funded. You're not making it easier by asking for "$350k to get to break even." That pitch has never excited any VC in the history of VC funding.

I'm not saying you should be asking for $10mm right out of the gate, but I'll share a story. I had a diverse founder recently pitch me asking for $800k to get to a "Phase One". When I asked about all the cool parts of the plan that I would have gotten excited about, that founder answered question after question with, "That will be for Phase Two when we have more funding."

After a bit, I finally asked, "What's the difference between One and Two in terms of funding and time, because I want to fund Phase Two way more than I want to get stuck in Phase One without funding." Turns out that Phase two was just a few months difference in time, but about 2x the funding--still well within what people raise in seed rounds, however.

I offered a term sheet to lead a $1.6mm financing.

That doesn't happen too often and that needs to change. While the onus should be on should be on founders to pitch the right amount, if you're a VC and you're dealing with a founder who has a good idea, it would be worth your while and there's to get at the heart of why they asked for a specific amount of money and what the right size of the round is. I'll bet the majority of the time, the diverse founders are undercutting themselves and not asking for what they really need, and I'll also bet it's affecting how ambitious you think they are, probably unfairly. If I was reading all of what's out there about funding and diversity, I might ask for just a little bit to prove myself, too!

BTW... that founder wound up raising an oversubscribed round of $2mm! Pretty sure they wouldn't have gotten there with just that $800k pitch.

What's also happening in the ecosystem is that diverse founders, even when they get offered investment, are getting worse deals. I'm not 100% sure what's going on here--but I believe the perception is that they're less likely to push back, or maybe they don't have as many options. If you think less VCs are going to back a diverse founder simply because they're diverse, and therefore, you're going to give them a worse deal, that's not in the least bit ethical in my book. You should ask yourself, "Is this the deal I'd give to a white guy with the same resume?"

I recently backed a female founder who raised some notes that had a conversion cap (a de facto price) of $1 million. It's literally the first time I've ever seen a cap that low and I really don't believe a guy would have been offered that cap, or if nothing else wouldn't have been expected to take it.

Instead, the founder asked around about the deal. Do you know what a VC backed male founder told her? He said that it's hard for women to get funding and she should take what she should get?

Makes my skin crawl.

How could that founder have been a better ally? He could have offered to vouch for her to the angel investors, and told them how that wasn't really a market deal--and encouraged them to offer something more in line with the market. Maybe they get there, maybe they don't--but it would have been a lot more helpful for a small investment of time.

Lastly, I think one of the missing components of the fundraising process is simply empathy. That's what struck me most about the responses I got to my e-mail last week--the need to understand what diverse founders are going through and encourage them to participate more in the ecosystem.

Candis Best wrote,

"In response to your MLK inquiry, as not only a Black tech founder but a Black female tech founder, my experience can best be summed up in one word - lonely. In fairness, that has as much to do with being a solo founder as it does with my background. However, I can also say that I feel less isolated in this role now than I did 18 months ago for one main reason - I had the good fortune of being part of the 2017 class of SLP. That experience did more to open my eyes to the connections, knowledge, and resources needed to build a business than all the pitch events I've attended and TechCrunch articles I've read combined. Had I not participated I don't how long it would have taken for me to realize how much (or how many people) I didn't know but needed to. I have no doubt there are many worthy Black-led startups who are wandering in the wilderness right now because they're still where I was then."

I can't echo that sentiment enough. You're going to be pretty discouraged if all you do is read headlines. You need to get out there and make those connections, because you need to.

The other note that struck me was this one, about the additional cognitive load that diverse professionals in tech experience:

"From my experience, I believe that being black in tech is about making a series of choices every day that other people simply don't have to think about. When I walk into an office of 70 people and see no other black or Latino/a person (my current situation) I have to choose to ignore how alarming that is so that I can get my work done. (blacks and Hispanics combined make up 52% of the NYC population, yet <6% of the tech workforce...that should alarm everybody.)

As the only person of color in all of my team meetings, I have to decide whether it is wise to give input or ask a question, knowing that I not only represent myself but all black people, and that a wrong answer or uninformed question could trigger a negative stereotype or foster a bias. For many of my white and Asian coworkers, the only black person they interact with regularly is me, so I can have a big impact on their worldview of minorities in tech.

Finally, when someone exhibits offensive or uncomfortable behavior (whether they realize that it's offensive or not), I have to make a decision to either call out that behavior at the risk of alienating myself from the 'tribe', or ignore it and maintain the idea that I'm 'chill' and a team player. In most cases, it's better to push past it.

For people of color, having to make these daily decisions on how to represent yourself is what takes away from tech being as amazing of an experience as it could be, certainly for me but I think for everyone. "

I really appreciate this response from Justin Sharp, because, not surprisingly, it's just not something I ever thought about--and it really does sound exhausting. If nothing else, it's help to understand the next time you drill down on someone's actions critically and assume we're all on an equal social playing field to start with. His advice:

"You nailed it when you said the best thing allies can do is listen, I can't emphasize this enough. Listening with empathy and believing what your peers are saying is invaluable. The other thing allies can do is check in with themselves about the diversity problem - do you really believe it's a problem, and do you understand why? Do you believe that it negatively impacts your equity in the company? If you don't personally feel the pain of a homogenous workplace or don't see the reward of being more diverse, then you may be less compelled to demand change."

Ok, well, this was longer than I intended and probably didn't even cover a tenth of what I could talk about on the topic, but, at some point, people are expecting me to send out this newsletter and it's getting late in the morning.

Thanks for listening.