Don’t Buy the Hype

“People calculate too much and think too little” – Charlie Munger

One of the core principles of Jackson Square Ventures is that we don’t buy hype. Don’t get me wrong – we love it when a company in our portfolio does exceptionally well and receives a lot of attention. We try to avoid buying hype when there is no substance - we look out for it before we ever invest. We try to avoid buying the sizzle when there is no steak. Let’s talk about how to do that.

First – let’s understand the source of hype in the first place. Why does hype occur? How does it spread?

Incubators and accelerators are breeding grounds of hype - they put lists of companies out there and have a demo day to display their wares. Angellist is a breeding ground for hype – so are Mattermark and CBInsights and Product Hunt and anywhere else that has a leaderboard for companies. Whether or not these entities intentionally build hype in companies is irrelevant… any time you have a leaderboard you will by default be putting someone at the top of a list, and if the leaderboard owner has credibility, the company at the top of the list will become hyped. Any time you have Techcrunch publishing articles like, “Our 9 Favorite Startups From Y Combinator Summer 2015 Demo Day 2”, you’re going to get some hyped companies. Any time you have a “Mindshare Score” that ranks all startups you’re going to end up with some hype. (note: the score is based on page views, downloads, links, twitter followers, facebook fans, and linkedin followers – that’s it). Notice the distinct absence of little things like revenue, customers, engagement metrics, or gross margin. The thing is, hype is easy to spot and it’s all public info – the things that usually matter most are all private info.

Hype sometimes spreads quite deliberately. Good founders are really good at building buzz and hype. (Great founders sometimes avoid it - more on that later) They’re good enough to build some buzz, get some angel investors to publicly invest in and endorse their company, introduce them to more angels, get solid press coverage, and write guest posts about the future of the xyz economy. They can raise “party rounds” quickly and they can create a sense of FOMO among investors. They can create temporary growth in vanity metrics like downloads. This can lead to lots of hype among investors and very rapid financings where VCs are forced to “act quickly” and provide term sheets in less than 48 hours. Many investors pride themselves on that ability.

Once a startup starts receiving attention, it can snowball and you get constant press coverage across Techcrunch, Re/code, etc. Hyped companies draw eyeballs, and media businesses are about getting lots of eyeballs. So, it is in their interest to talk about whatever drives views and engagement, and once a hyped company becomes well-known, people want to read everything about that company… for a little while. The hype cycle can come and go very quickly – and oftentimes, a company may enjoy just a couple weeks of lots of limelight. But that may be all that’s needed to grab a financing from investors that moved very quickly.

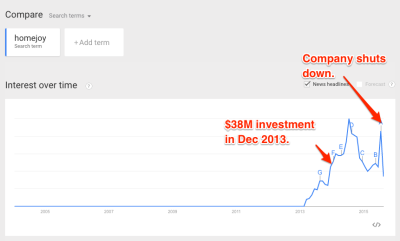

This is what investing in hype looks like:

At Jackson Square Ventures, we look for great teams building underlying great businesses with sustainable metrics and increasing economies of scale or network effects. We look for strong SaaS metrics (see this great post on SaaS metrics from my friend at Cueball Capital, Ali Rahimtula). We read a lot of articles, but we try to limit its influence in our decision-making process. We go to demo days and subscribe to CBInsights, but again, we debate vigorously internally and do not let external sources make up our mind. Frankly, we trust our instincts and our qualitative research and customer diligence more than we trust the number of twitter followers or the increase in Google Trends. There are too many ways to get “unhealthy” growth in this business. That’s one of the reasons you can’t just rely on data – most of the data can’t tell the difference between healthy and unhealthy growth. If we believe that a business has strong fundamentals and will continue healthy growth for many years to come – we will invest.

We find unhyped companies all over the place – but you have to look harder and be willing to bet on companies that don’t fit the mold. They are sometimes created by first-time founders. Sometimes they’re founded by more mature founders that are over the Silicon Valley median founder age. Sometimes they are immigrants to the US that have moved their startup here to grow. Sometimes they are just building software for unsexy industries like the $380 billion global shipping industry. We have founders and wonderful portfolio companies in Seattle, San Diego, Chicago, and Atlanta. And, of course, we also have companies in San Francisco that have been through startup incubators.

So, in contrast, this is what it looks like to invest BEFORE hype. Note that each of the three companies listed below are all very successful and took 1 year or more after our investment to reach a more ‘hyped’ state. That’s because they have underlying great businesses that do not depend on the media hype machine. And they tend to grow more slowly and more steadily than the pure hype companies.

I mentioned earlier that the great founders avoid the hype. Why is that? Well, great founders want a monopoly. Hype invites competition. The great ones wait until they are completely dominant in an industry to start talking about what they’re doing. Hype just strokes their ego a little bit, and that’s one thing they don’t need.

If you’re building a business that’s flying under the radar and you have strong fundamentals, give us a call. We’d love to chat.

jbreinlinger posted this

jbreinlinger posted this