Take Five – Venture

VC Cafe

JULY 4, 2022

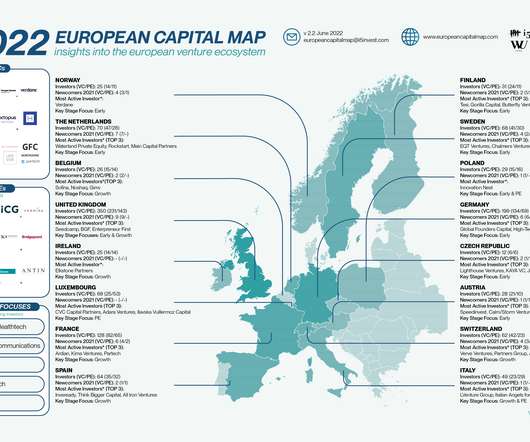

Another impact of the meltdown of the public markets is on performance, in LP and VC books which resulted in 68% of funds estimated to have marked down companies in their portfolio. Narrative violation: VC investment in EMEA startups reached an all-time high in the first half of 2022. billion in June 2021. Source: The Economist.

Let's personalize your content