State of VC 2.0

View from Seed

SEPTEMBER 14, 2021

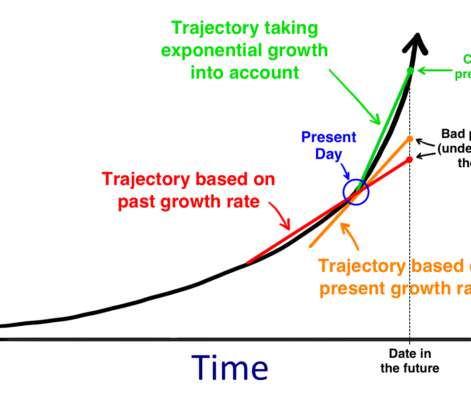

That’s a bit of a cautionary tale to VC investors today who might think it’s inevitable that the private value they are enjoying in their portfolios will certainly translate to distributions in the near future. Was this a lost decade for venture capital? Both early- and late-stage startup valuations are currently elevated.

Let's personalize your content