Where are the Deals? How VCs Identify the Next Generation of Startups

David Teten

FEBRUARY 3, 2014

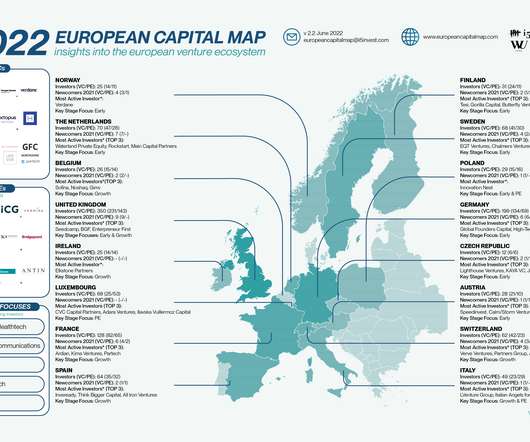

Prior to joining ff Venture Capital , I published the first-ever study of how private equity and venture capital funds originate new investments, with my coauthor Chris Farmer , CEO of SignalFire and an experienced VC. Leading Late-Stage Technology Investors’ Portfolio by Geography, 2001-1Q2010.

Let's personalize your content