State of VC 2.0

View from Seed

SEPTEMBER 14, 2021

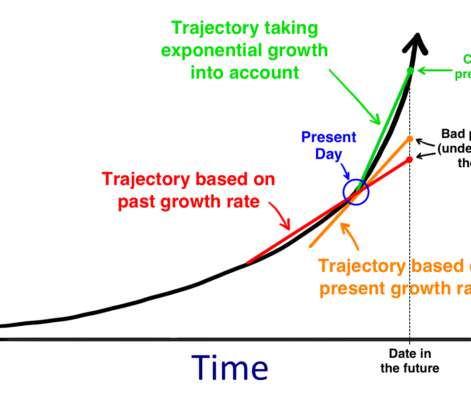

Warning – this assumes some basic knowledge of VC performance metrics. One thing that jumps out quickly is that TVPI between 2004-2010 (avg 2.6x) has underperformed 2011-2017 (avg 3.0x). Both early- and late-stage startup valuations are currently elevated. For a primer, I would recommend refreshing yourself here.

Let's personalize your content