What Do Industry Insiders Think Will Happen in VC in 2016?

Both Sides of the Table

FEBRUARY 4, 2016

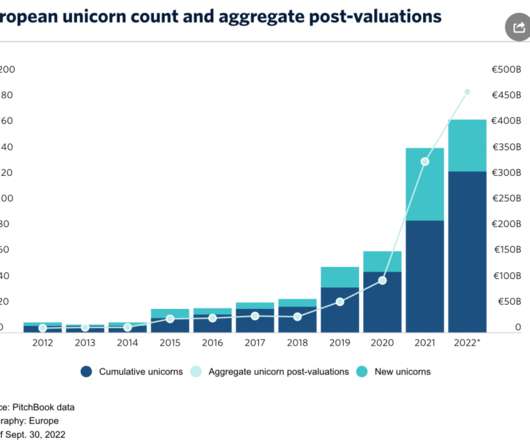

.” There are a lot of data points that one can observer to get a sense of the venture capital markets – both LP fundings into venture and VC financings of startups. They point to some widely known facts: financings & valuations are up massively over the past 7 years and non-VC money has entered the system.

Let's personalize your content