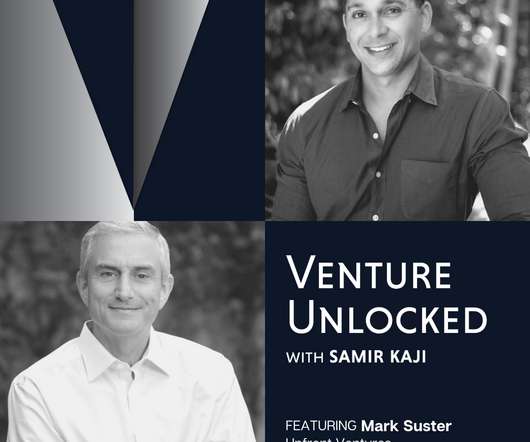

What Do LPs Think of the Venture Capital Markets for 2016?

Both Sides of the Table

MARCH 1, 2016

At the Upfront Summit in early February, we had a chance to have many off-the-record conversations with Limited Partners (LPs) who fund Venture Capital (VC) funds about their views of the market. …But LPs Have Been Putting Out More Money Than They Are Getting Back. That’s money that fuels our startup ecosystems.

Let's personalize your content