On Bubbles … And Why We’ll Be Just Fine

Both Sides of the Table

JUNE 22, 2011

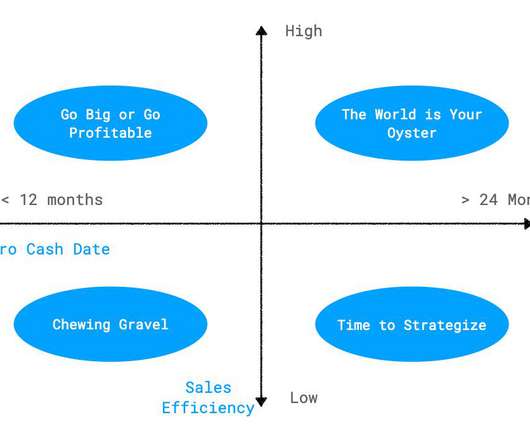

New investors hate down rounds. Huge structural under-employment in much of the country and full employment in some niche tech markets where it’s impossible to hire developers, designers or sales professionals. So I’m not advocating panic or a need to rush your funding round. Get funded now, if you can.&#.

Let's personalize your content