Can You Trust Any vc's Under 40?

Steve Blank

SEPTEMBER 14, 2009

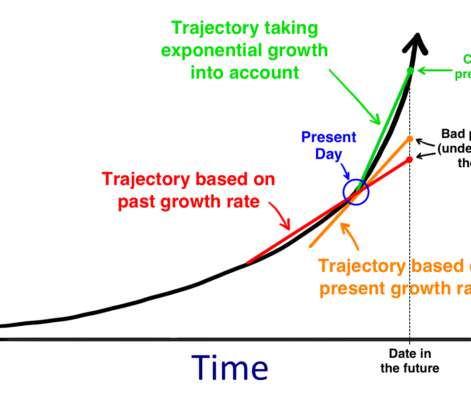

Posted on September 14, 2009 by steveblank Over the last 30 years Wall Street’s appetite for technology stocks have changed radically – swinging between unbridled enthusiasm to believing they’re all toxic. Large companies were acquiring technology startups just to get in the game at the same absurd prices.

Let's personalize your content