Is @AngelList Syndicates Really Such a Big Deal?

Both Sides of the Table

SEPTEMBER 29, 2013

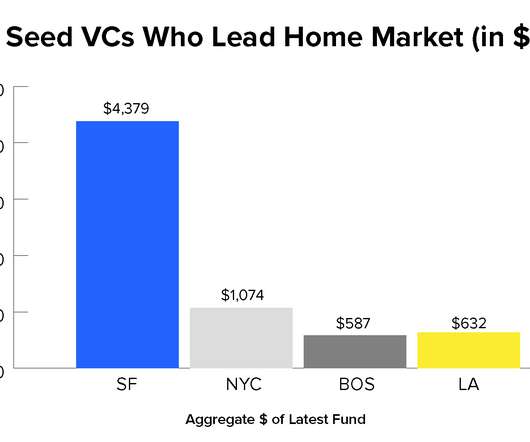

It should help some entrepreneurs to better access early-stage capital and should allow some angel investors better access to deal flow. In Jason’s mind half of the VC industry will now disappear as entrepreneurs flock to him and to Dave Morin for their money. It’s hard to be a great lead investor .

Let's personalize your content