What Founders Need to Know: You Were Funded for a Liquidity Event – Start Looking

Steve Blank

MARCH 16, 2016

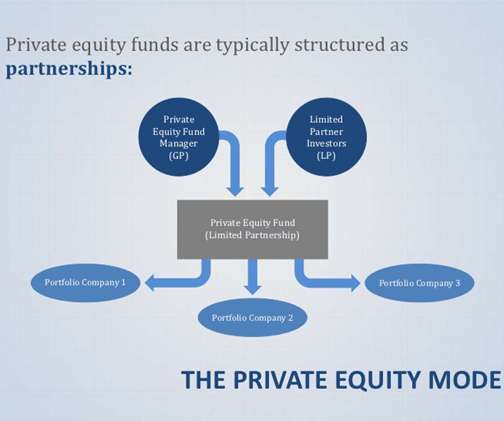

Founders can now access the largest pool of risk capital that ever existed –in the form of Private Equity (Angel Investors, family offices , Venture Capitalists (VC’s) and Hedge Funds.). At its core Venture Capital is nothing more than a small portion of the Private Equity financial asset class. The Deal With the Devil.

Let's personalize your content