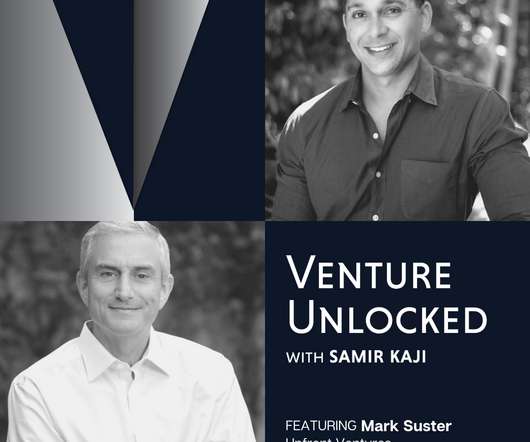

What Do LPs Think of the Venture Capital Markets for 2016?

Both Sides of the Table

MARCH 1, 2016

At the Upfront Summit in early February, we had a chance to have many off-the-record conversations with Limited Partners (LPs) who fund Venture Capital (VC) funds about their views of the market. LPs See The Over-Valuations and Don’t Like It. All isn’t completely rosy in the LP views of the venture industry.

Let's personalize your content