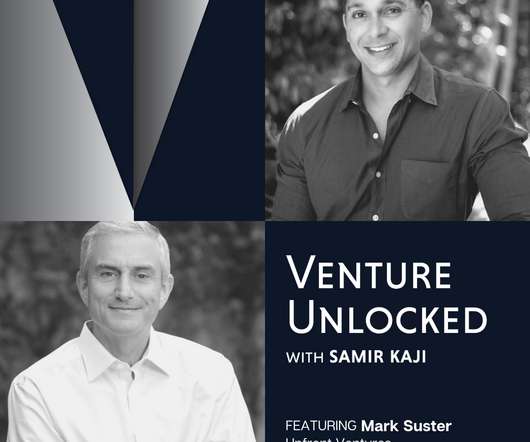

What Mistakes Do VCs Make When Fundraising?

Both Sides of the Table

JUNE 22, 2021

I counsel first-time VCs (as well as founders) to have mid-funnel strategies to get from first LP meeting to close and to put a disproportionate amount of time into this area (I say more about this on the podcast starting at timecode 27:41). And again, just like in enterprise sales, this is all about differentiation ?—?what

Let's personalize your content