A founders’ guide to capital raising

NZ Entrepreneur

AUGUST 4, 2021

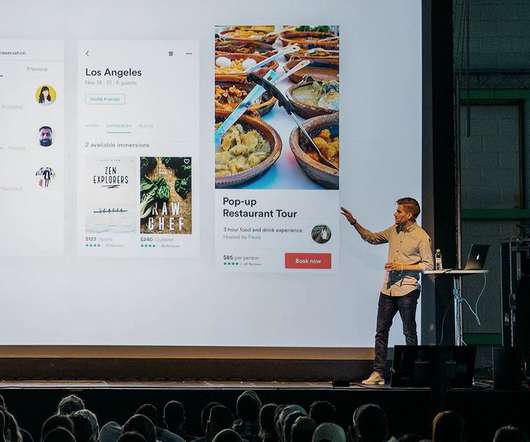

Byron van Vugt from NZ Growth Capital Partners explains. For investors, capital raises provide an opportunity to invest in a company’s ambitions. Be sure to share your story and vision with people ahead of pitching to investors. Depending on the type of investor, you might receive an invitation to present your pitch deck.

Let's personalize your content