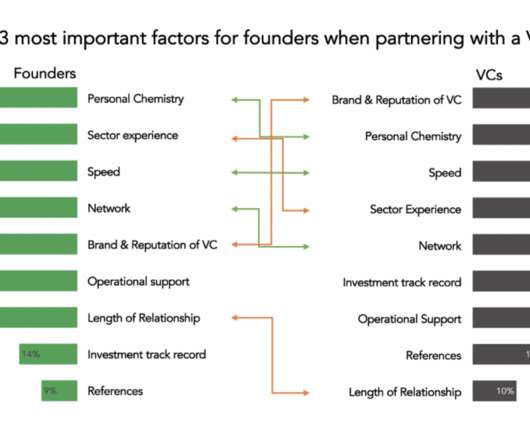

Investors Think They’re More Impactful Than They Actually Are

VC Adventure

JUNE 14, 2022

Indeed, many firms even institutionalize the practice of providing help to portfolio companies through extensive platforms that may include PR, talent, marketing, technical, and other help (sometimes offered for free, sometimes offered ads a pay-for-service, but often at below-market rates for those services).

Let's personalize your content