Forecasting ecommerce multiples at exit

The Equity Kicker

DECEMBER 2, 2015

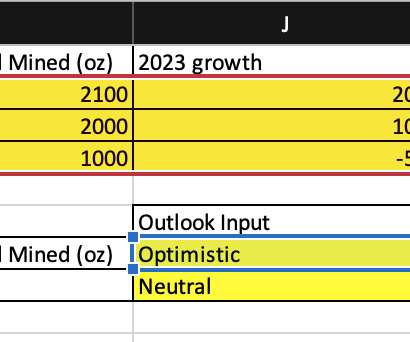

1-800 Flowers, meanwhile is valued at 0.6x revenues because growth is much lower – forecast at 5-7% next year, and their EBITDA margin is 8%. They reported 168% YoY revenue growth in the Q3 earnings report and their EBITDA margin is 19%.

Let's personalize your content