Accel 2021 Euroscape: On the path to global dominance?

Cracking the Code

MARCH 28, 2022

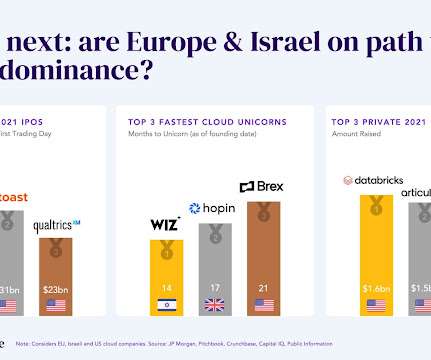

Today, Europe and Israel have generated 23 public companies worth $231B and private cloud financing reached c. The $900M of SaaS VC funding in 2015 now represents less than Europe's largest financing round, with Celonis raising $1B in June this year. The cloud IPO market has also been very active with 32 IPOs vs. 17 in 2020.

Let's personalize your content