Pre-Seed: faster deck reviews, longer fundraising time

VC Cafe

SEPTEMBER 2, 2022

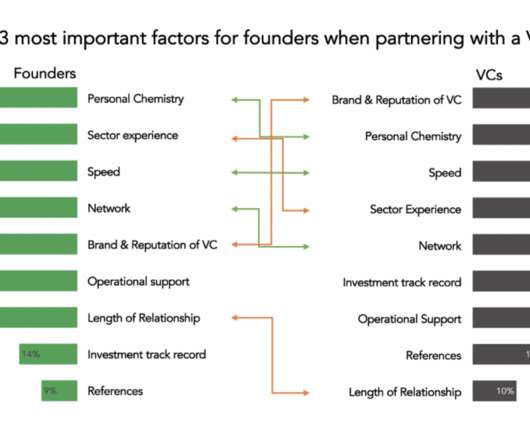

That’s on average the time venture capital investors spend on a pre-seed pitch deck, according to the latest Dropbox/Docsend funding research report. The time spent on reviewing decks went down compared to 2021. I touched on this in my post “ Founder Investor Fit “ Passing the initial filtering process.

Let's personalize your content