The B2C SaaS Landscape and the Bundle Wars

VC Cafe

SEPTEMBER 21, 2020

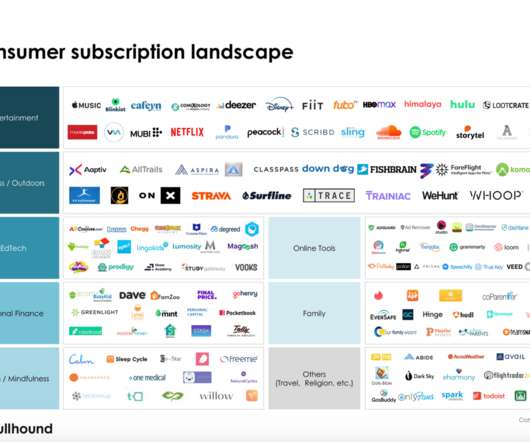

The tech industry is obsessed with the consumer subscription model, or B2C SaaS. Many startups are hoping to be the next name on that list. The landscape of consumer subscription startups is growing: Consumer SaaS landscape (Source: GP Bullhound ). The post The B2C SaaS Landscape and the Bundle Wars appeared first on VC Cafe.

Let's personalize your content