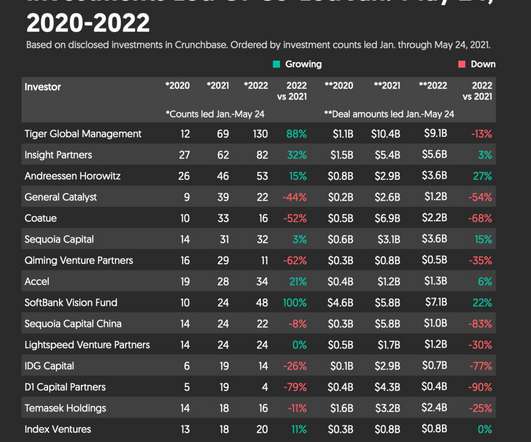

Take Five – how shut are the venture markets right now?

VC Cafe

JUNE 10, 2022

While these prices are still high compared to what we see in Israel, Investors have putting a stronger focus on revenue growth (and in particular startups that can reach substantial revenue targets) especially before series A. That’s why Bessemer ventures coined a new term, reflecting that revenue is king.

Let's personalize your content