Hammer or Hands?

View from Seed

JANUARY 2, 2024

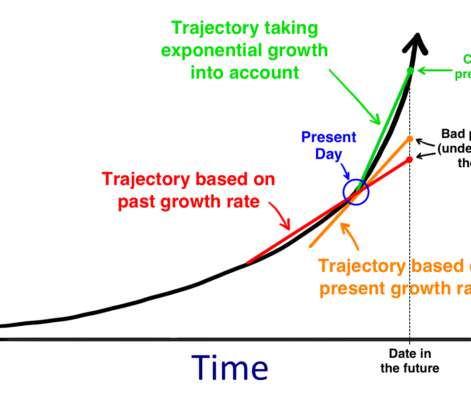

I think a big question facing early stage investors is: are you a hammer? In the prior era of early stage investing, pre-seeds and seeds “fit” into neat buckets slotted in ahead of the neat buckets of series A’s and B’s. Some folks will continue to define stages in narrow terms.

Let's personalize your content