Why The Government is Isn’t a Bigger Version of a Startup

Steve Blank

NOVEMBER 12, 2019

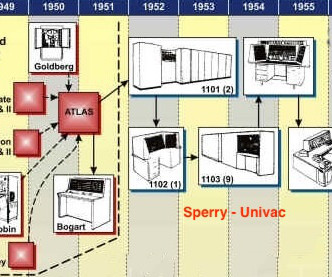

As there was no venture capital, these early startups were funded by early sales to weapon systems prime contractors and subcontractors. Within a decade, the rise of venture capital in Silicon Valley enabled startups to find commercial customers rather than military ones. The Government Can’t Act Like a Startup.

Let's personalize your content