5 Steps To Finding The Best Investor For Your Startup

Startup Professionals Musings

FEBRUARY 10, 2023

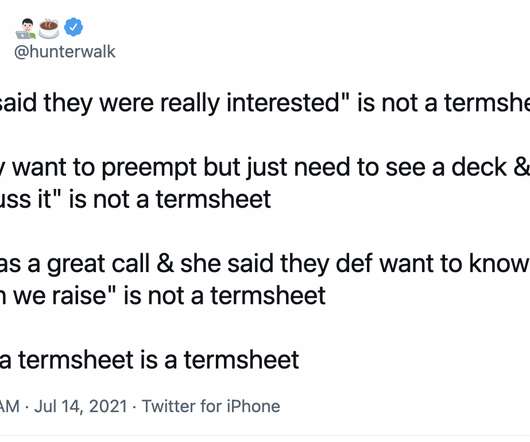

Even though the color of their money is always green, all startup investors are not the same. Taking on equity investors to fund your company is much like getting married – it is a long-term relationship that has to work at all levels. Personally visit another startup funded by this investor. It’s no fun for either side.

Let's personalize your content