Can You Trust Any vc's Under 40?

Steve Blank

SEPTEMBER 14, 2009

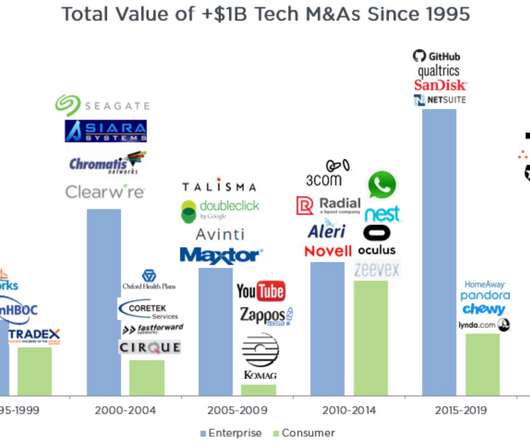

Five Quarters of Profitability During the 1980’s and through the mid 1990’s startups going public had to do something that most companies today never heard of – they had to show a track record of increasing revenue and consistent profitability. The world of building profitable startups as the primary goal of Venture Capital would end in 1995.

Let's personalize your content