Want to Know a Secret? Your Customers Do.

ConversionXL

NOVEMBER 27, 2019

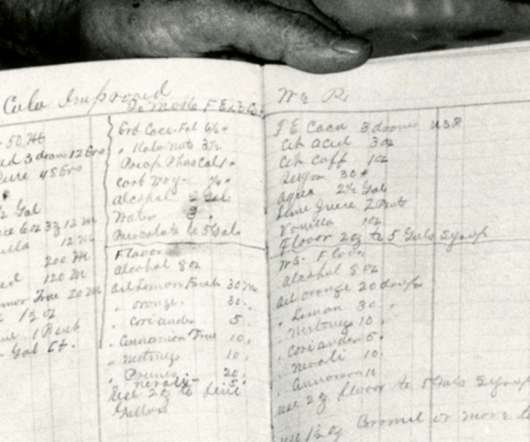

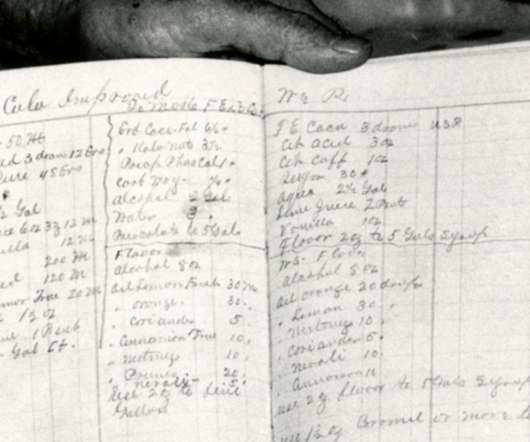

The New York Times, January 2001. Dean Kamen’s code name for the project was “Ginger.” Finally, in December 2001, came the big reveal: Ginger was the Segway. . For marketers, then, the goal is to distribute that secret, in full or part, for maximum impact: To create real value for Insiders. That was all most people knew.

Let's personalize your content