Updating Your Seed Investors – Board Deck & Update Email Templates

View from Seed

JULY 8, 2020

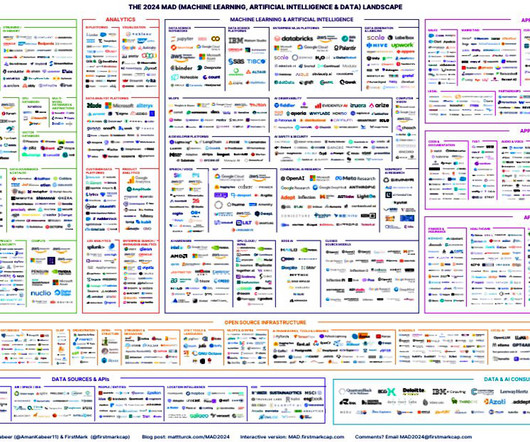

Today I’m excited to announce the relaunch of our most popular resource ever: board meeting deck templates for seed-stage startups, now in conjunction with an investor update email template. Yet the landscape for the seed stage has evolved over that period. Download Board Deck Template .

Let's personalize your content