Looking Back On Tech, Startups, And VC In 2018

Haystack

DECEMBER 29, 2018

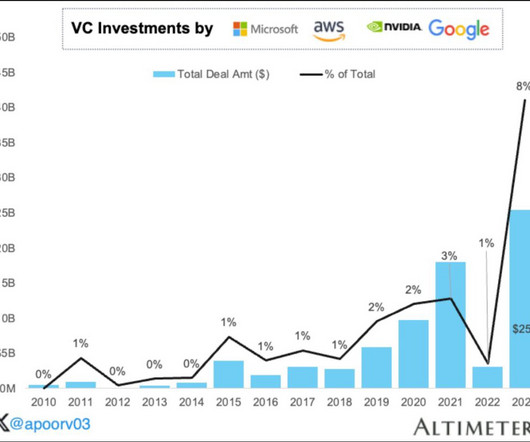

6/ Venture Capital In Expansion Phase. Technology is, like water, flowing and seeping into nearly every sector and eventually into most of the global economy. More and more angels will be minted as the 2019 IPO class emerges. companies, more sensitivity around technology IP and security. 3/ Crypto Hibernation.

Let's personalize your content