Even the Smartest VCs Sometimes Get it Wrong – Bill Gurley and Regulated Markets

Steve Blank

NOVEMBER 7, 2023

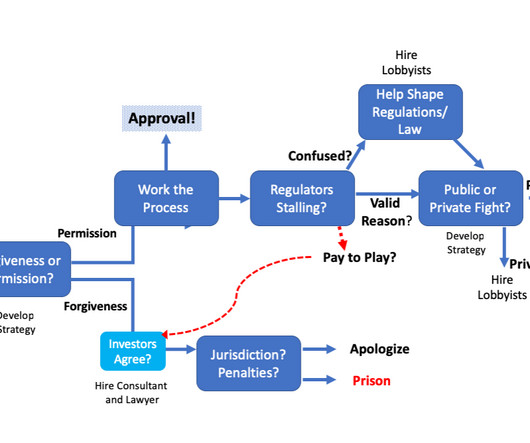

He illustrated his talk with regulatory horror stories in the telecom market , electronic health records , and Covid antigen tests. Unfortunately, for startups entering a regulated market following this advice this might not be the optimum path. But regulated markets are different. Regulation What’s regulatory capture?

Let's personalize your content