Want to Know a Secret? Your Customers Do.

ConversionXL

NOVEMBER 27, 2019

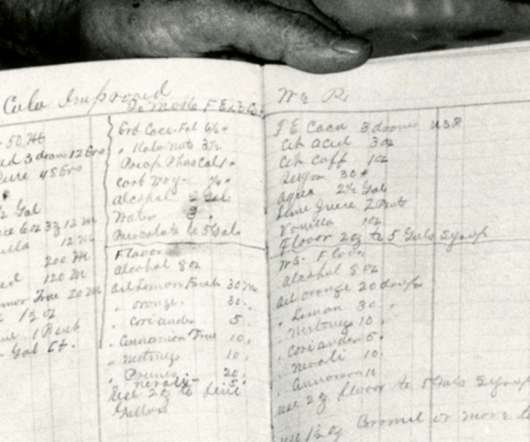

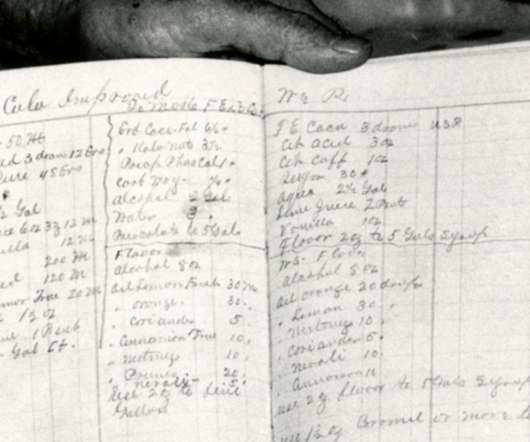

The New York Times, January 2001. Finally, in December 2001, came the big reveal: Ginger was the Segway. . Secrets deliberately withhold information—briefly or indefinitely—for company benefit at consumer expense. Does a “CLASSIFIED” stamp make information more persuasive? That was all most people knew. Image source ).

Let's personalize your content