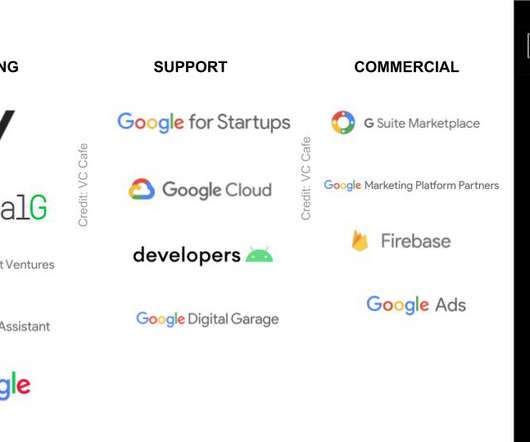

How can startups engage with Google?

VC Cafe

JULY 21, 2020

In the past I’ve covered the rise of corporate venture capital and the growing number of Fortune 500 companies who are actively launching CVC arms or investing in startups/funds. Applications for various programs in Europe and Israel are open. But investing is only part of the picture.

Let's personalize your content