Acquire New Users by Adding Growth Hacking to your Marketing Strategy

ConversionXL

FEBRUARY 3, 2022

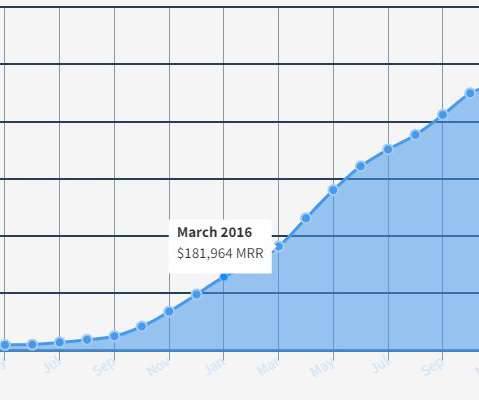

Neither would have achieved virality had customers not received something tangible for their efforts. 500 Startups founder and entrepreneur Dave McClure created this model as a way for growth hackers to optimize the speed of their sales and marketing efforts in generating results. ConvertKit’s early success came from cold emailing.

Let's personalize your content