How to Get Superior Returns in Venture Capital

David Teten

JANUARY 9, 2018

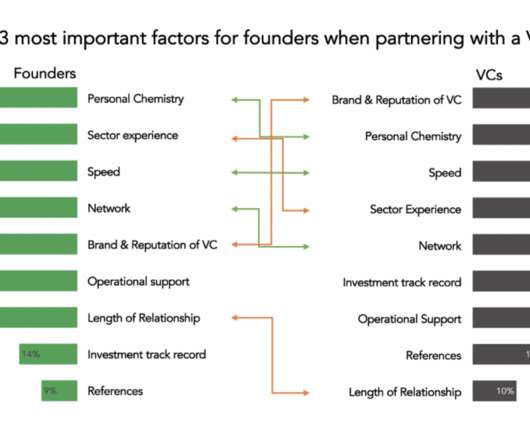

Many VCs focus on specific verticals, usually based on the sector in which a VC initially made her reputation. Social media tools like Linkedin and FullContact increases the value of network currency (reputation and access), because people with currency can spend their currency getting to a wider array of influencers. – Network.

Let's personalize your content