How’s Venture Capital Changing in 2023

VC Cafe

FEBRUARY 27, 2023

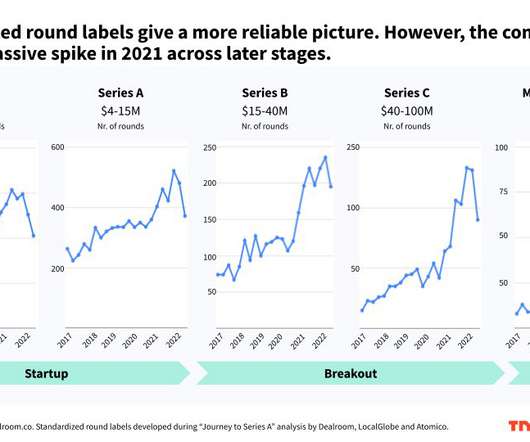

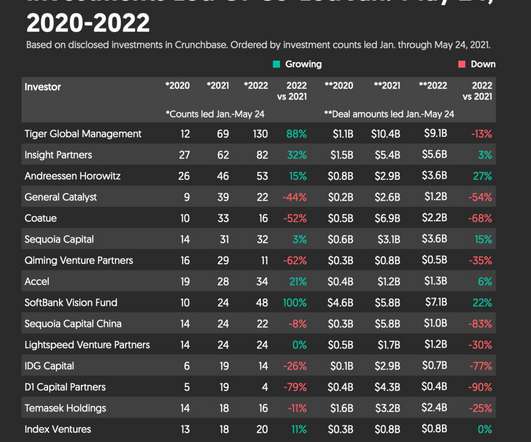

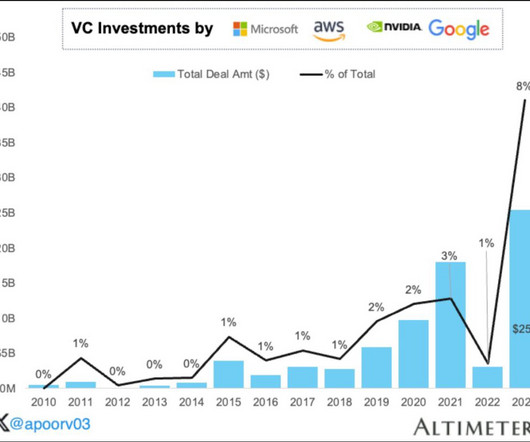

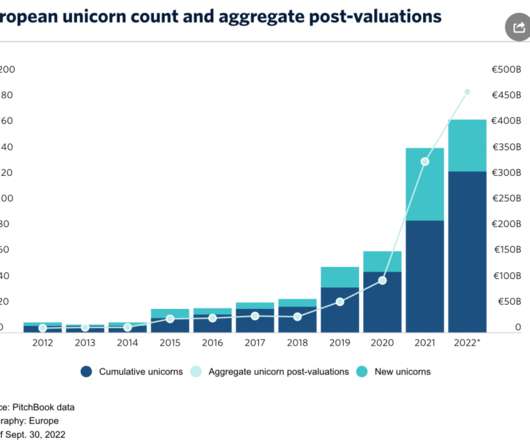

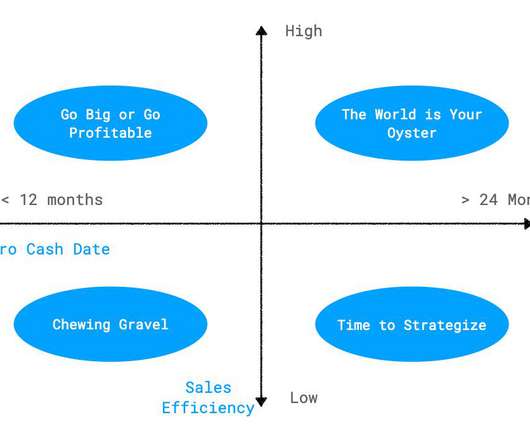

Taking stock of the venture capital market in 2023, it’s clear to see that we’re in a transition point. Prices went up from round to round, and startups were encouraged to grow, grow, grow, and not to worry about profitability. The post How’s Venture Capital Changing in 2023 appeared first on VC Cafe.

Let's personalize your content