Why Uber is The Revenge of the Founders

Steve Blank

OCTOBER 24, 2017

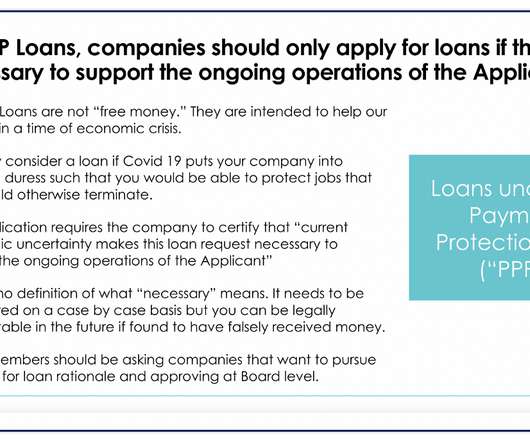

The founders along with all the other employees would vest their stock over 4 years (earning 1/48 a month). They had to hang around at least a year to get the first quarter of their stock (this was called the “cliff”). Founders are taking control of the board by making the common stock the founders own more powerful.

Let's personalize your content