A founders’ guide to capital raising

NZ Entrepreneur

AUGUST 4, 2021

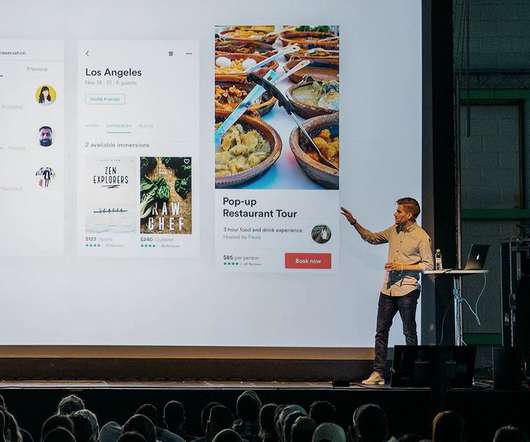

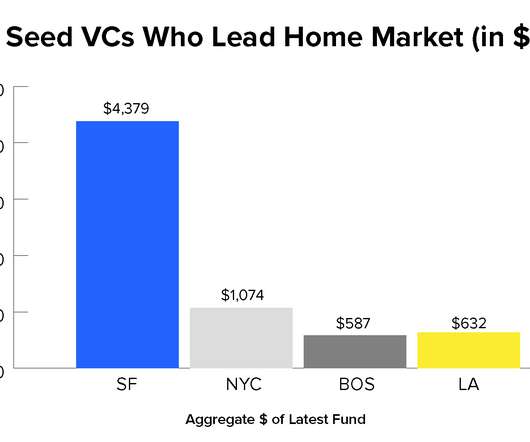

Byron van Vugt from NZ Growth Capital Partners explains. For investors, capital raises provide an opportunity to invest in a company’s ambitions. In the early days, investors invest in you more than your business, so relationship-building should take precedence. Lead investors and term sheets. Legal documentation.

Let's personalize your content