Dan Lok Explains Venture Capital Funding and How to Secure It

The Startup Magazine

SEPTEMBER 15, 2020

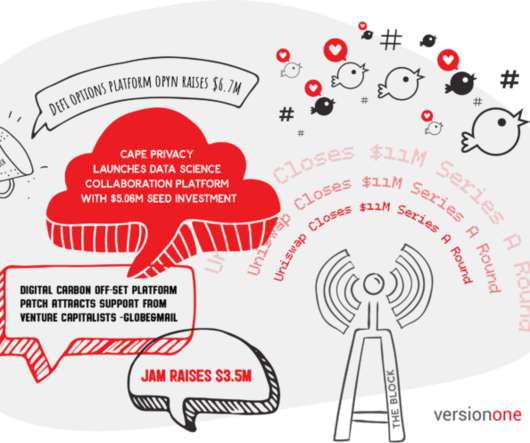

This is especially true if the company lacks access to capital markets or bank loans. Understand VC Term Sheets. A venture capital term sheet is a “non-binding listing of preliminary terms for venture capital financing”. This means that they have a say in your company’s decisions.

Let's personalize your content