Change Your Management Style To Meet Today’s Culture

Startup Professionals Musings

MAY 24, 2019

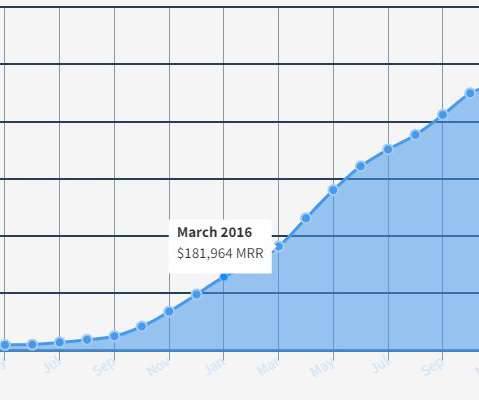

Yet, in my daily role as an advisor to entrepreneurs and small business owners, struggling to boost revenues, profits, and earnings, I still see too many managers falling back on command-and-control, a focus on weaknesses, and not enough time for people. They want ongoing conversations, not just annual reviews.

Let's personalize your content