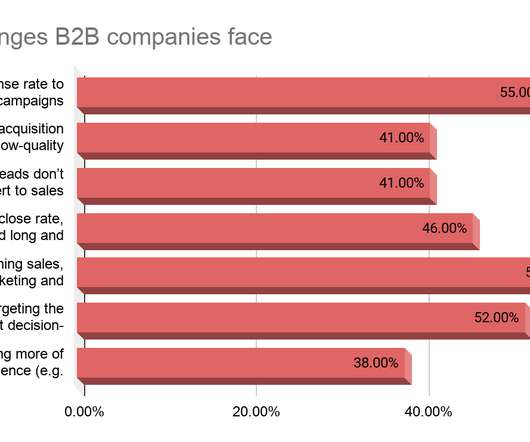

Common B2B Challenges and How To Solve Them

ConversionXL

MARCH 17, 2021

Last September (2020), six months after the 1st lockdown, my co-founder Vladimir Blagojevic and I decided to run market research to figure out what challenges B2B companies face and how they solve them. And while this was a good start, a significant position of these companies were early-stage startups. Let’s dive in.

Let's personalize your content