The State of Gaming in 2022

VC Cafe

JULY 21, 2022

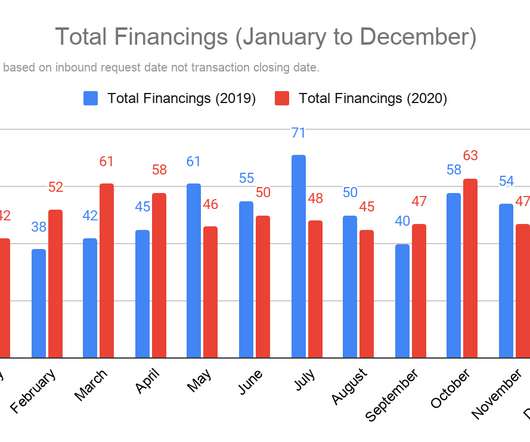

billion people globally that play games in 2022. The global games and services market is forecast to reach $188 billion in 2022, a 1.2% Private financing market continued to see strong deal activity with $3.6B in total financings in Q2, surpassing Q1 total through 169 deals. The merger of Unity and Ironsource (a $4.4

Let's personalize your content